Every week we release educational videos related to hot topics in the mortgage industry on YouTube.

Subscribe to our channel to stay in-the-know!

Thinking of buying a home? Understanding the timeline of the home-buying process is crucial to make your journey smoother and less stressful. Whether you’re just starting to dream of upgrading your space or you’re spending all your free time looking for a house, this guide will walk you through the key stages, from initial contact with a lender to closing on your dream home.

The journey begins when you first start thinking, “My home is too crowded” or “I need a bigger yard for the kids” or “I'm ready to down-size.” Once those thoughts arise, it’s time to take the next steps.

Contact a Local Lender: Your lender is your partner in securing the financing for your home. A local lender will have their finger on the pulse of the Texas market and can guide you through state-specific requirements.

Schedule a 15 minute appointment to talk with me.

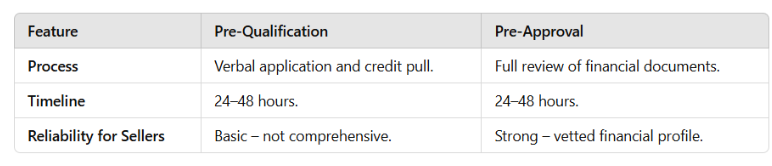

Pre-approval is one of the most critical steps in the home-buying process. It shows sellers you’re a serious buyer and gives you a clear idea of your budget.

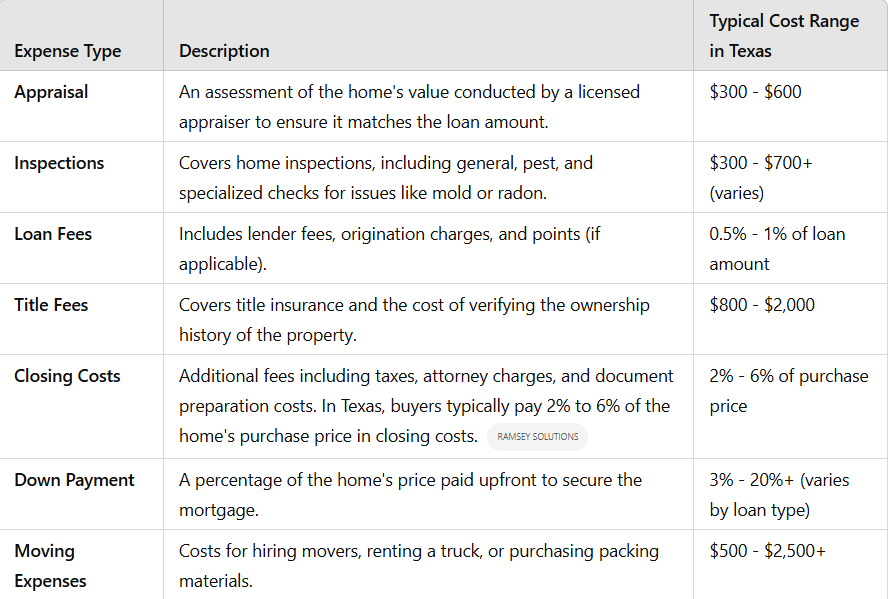

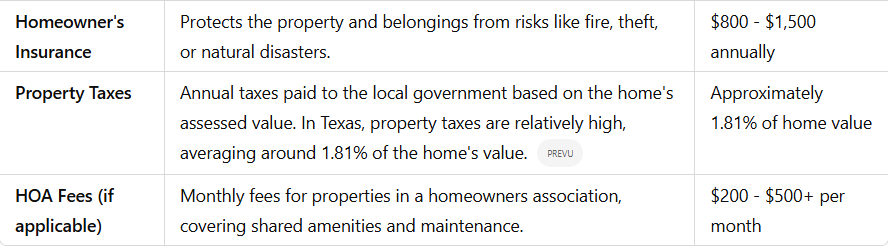

Here is a breakdown of expenses you can expect when buying a house

Step 3: Begin the Home Search (1-4 Months)

Now that you’re pre-approved, it’s time to find your dream home.

Check out first-time homebuyer tips in Texas.

Once you’ve found a home, you’ll work with your realtor to make an offer. After the seller signs the contract to accept the offer, the contract-to-close process begins.

During this time, it’s important that you do not make any big purchases, max out your credit cards or make large bank deposits that cannot be connected to your income. Changes to your financial situation can be detrimental to your purchase.

Here’s what to expect during the four weeks of the contract-to-close phase:

Congratulations, you’ve made it! On closing day, you’ll meet with the title company or a notary public to sign the final legal documents, finalize your down payment, and officially become a homeowner. Once documents are signed and recorded with the county, the property officially is yours!

Buying a home is an exciting journey, and with the right team by your side, the process can be seamless. Ready to start? Schedule a consultation with a Texas-based lender today.

All Rights Reserved | Jennifer Hughes Hernandez | Senior Loan Officer | NMLS #514497

Full service residential lender with an experienced team offering expert service, reliable communications and on-time closings in the greater Houston area.

Every week we release educational videos related to hot topics in the mortgage industry on YouTube.

Subscribe to our channel to stay in-the-know!

Gardner Financial Services, Ltd., dba Legacy Mutual Mortgage, NMLS #278675, a subsidiary of Texas Partners Bank. 18402 U.S. Highway 281 N, Ste. 258, San Antonio, TX 78259. AZ BK-2001467. Check registration and licensing at nmlsconsumeraccess.org. Legacy Mutual Mortgage is an Equal Housing Lender. This is not a commitment to lend. Material is informational only and should not be construed as investment or mortgage advice. Legacy Mutual Mortgage is not an agency of the federal government. Not all loan products are available in all states. All loans are subject to credit and property approval. Not all applicants qualify. Restriction and conditions may apply. Information and programs current as of date of distribution but may change without notice. [11/2025]