Every week we release educational videos related to hot topics in the mortgage industry on YouTube.

Subscribe to our channel to stay in-the-know!

If you've been holding off on buying a home because of high interest rates or increasing home values, you're not alone. Many Texans are feeling the pinch as affordability becomes a hot topic in the housing market. However, waiting indefinitely might not be the best strategy. Let’s break down what’s happening in the Texas housing market, what’s expected for interest rates in 2025, what 2025 could bring, and why now might be the right time to act.

Since January 2022, interest rates have almost doubled. This sharp rise has left many potential buyers wondering if it’s worth taking the leap. For renters, the rising cost of living and climbing home values make ownership seem out of reach. Meanwhile, current homeowners are reluctant to sell and lose their historically low interest rates, more than fifty percent of which are under 4%.

But here’s the thing: housing trends in Texas are stabilizing. The market is no longer as unpredictable as it was during the COVID-19 years. With the right information and timing, you can make smart decisions about buying or selling in this changing environment.

Texas’s housing market is unique. Cities like Houston, Dallas, and Austin continue to attract buyers due to job opportunities, no state income tax, and a relatively affordable cost of living compared to other states. Here are the key trends you should know:

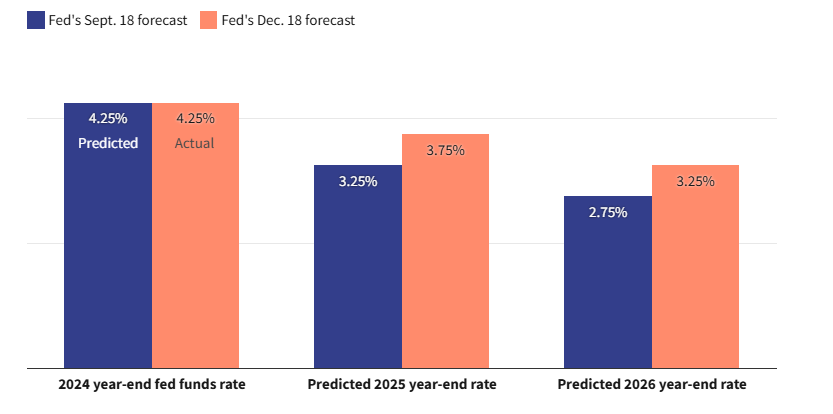

Interest rates are expected to remain between the high fives and low sixes through 2025. While this isn’t as low as the sub-3% rates during the pandemic, it’s far from the double digits we saw in the 1980s. Mortgage rates are influenced by the 10 year bond market and economic conditions, meaning sudden, steep drops are unlikely unless there’s a major economic downturn.

What You Can Do:

If you’re waiting for a major drop in rates, consider buying now and refinancing later when rates improve instead of missing out on a good deal today.

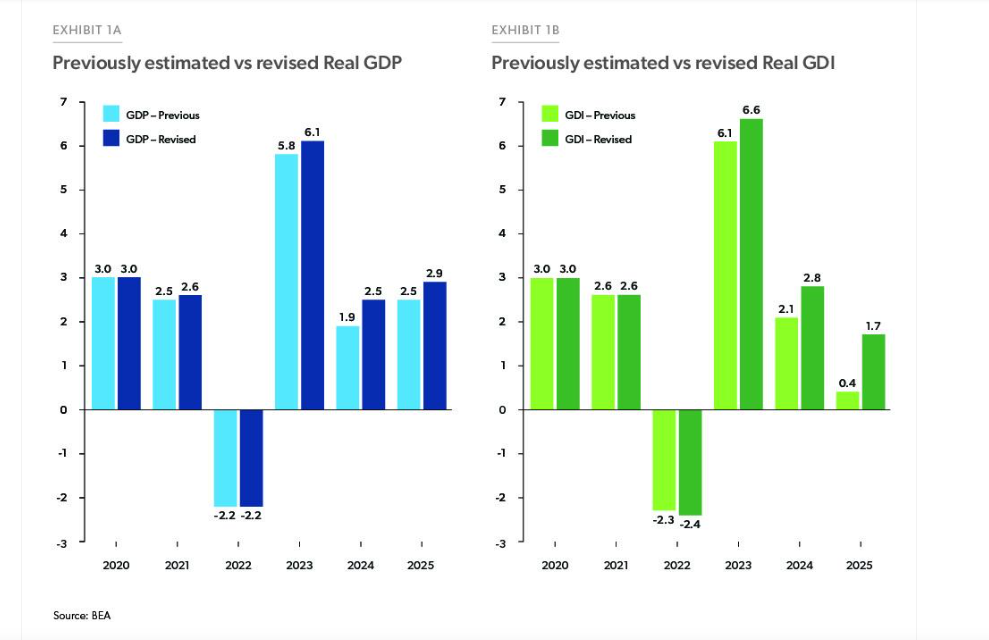

While Texas saw amazing home value appreciation during the COVID-19 pandemic, prices are beginning to stabilize. In many areas, the rapid growth of 2020–2021 has slowed, and prices are increasing at a more manageable rate. This trend benefits buyers by reducing the urgency and competition of previous years.

What This Means for Buyers and Sellers:

INSERT GRAPH OF PRICES STABILIZING

Low inventory remains a challenge, as many homeowners are holding onto their properties due to low interest rates. However, there’s been a slight uptick in inventory as sellers who need to upgrade or downsize enter the market. A healthy housing market has about 6 months of inventory, and we are seeing nationwide an average of just under 2 months inventory. Buyers are still demanding more inventory.

The Bottom Line:

Buyers have more options than they did in the past two years, but competition is still present, especially in highly desirable areas.

Want to see what’s available in the Houston Texas Area?

The Federal Reserve’s rate hikes have increased borrowing costs across the board, from credit cards to car loans. The average credit card APR now exceeds 22%, which adds financial pressure for many households. This has made leveraging home equity a smart financial move for some.

How This Affects You:

If you’re carrying high-interest debt, using home equity to consolidate higher interest rate debt can lower your monthly expenses and reduce financial stress.

Considering Refinancing? Book an appointment with me to talk about your options.

Texans who own homes have significantly more wealth than those who rent. The average homeowner’s net worth is $415,000, compared to $10,000 for renters. This wealth disparity is largely due to the equity homeowners build over time, especially over the last 4 years, where property values have appreciated in most areas across the nation faster than usual.

For Renters Considering Buying:

The longer you wait, the more you miss out on the opportunity to build equity and grow your net worth.

Why homeownership is key to building wealth

A concern I hear almost every week is either that we are in a housing bubble, or there is the potential for a housing bubble. However, experts agree that today’s market is vastly different from the 2008 housing bubble. Stricter lending standards, lower foreclosure rates, and limited inventory make a repeat of the last housing crash unlikely.

Key Differences Between 2008 and Now:

Why Texas’s housing market remains resilient

According to market forecasts:

The decision ultimately depends on your individual circumstances. Here’s a quick guide:

Find a Texas real estate agent

In Texas, the housing market remains strong, and opportunities are still abundant for buyers and sellers alike. Waiting for rates or prices to drop significantly is going to leave you stuck on the sidelines while others build wealth through homeownership. Whether you’re a first-time buyer or a seasoned homeowner, continuing to wait might not be in your best interest.

Ready to take the next step?

Reach out to a local real estate expert or lender to discuss your options. Don’t let fear of the unknown keep you from securing your future.

Ready to talk? Set up a 15 minute call with me today!

All Rights Reserved | Jennifer Hughes Hernandez | Senior Loan Officer | NMLS #514497

Full service residential lender with an experienced team offering expert service, reliable communications and on-time closings in the greater Houston area.

Every week we release educational videos related to hot topics in the mortgage industry on YouTube.

Subscribe to our channel to stay in-the-know!

Gardner Financial Services, Ltd., dba Legacy Mutual Mortgage, NMLS #278675, a subsidiary of Prosperity Bank. 18402 U.S. Highway 281 N, Ste. 258, San Antonio, TX 78259. AZ BK-2001467. Check registration and licensing at nmlsconsumeraccess.org. Legacy Mutual Mortgage is an Equal Housing Lender. This is not a commitment to lend. Material is informational only and should not be construed as investment or mortgage advice. Legacy Mutual Mortgage is not an agency of the federal government. Not all loan products are available in all states. All loans are subject to credit and property approval. Not all applicants qualify. Restriction and conditions may apply. Information and programs current as of date of distribution but may change without notice. [11/2025]